2022-04-26

Apr 27 In-Class Exercise .

Please post your solutions to the Apr 27 In-Class Exercise to this thread.

Best,

Chris

Please post your solutions to the Apr 27 In-Class Exercise to this thread.

Best,

Chris

2022-04-27

import math

a = {

"california": 95,

"business": 601,

"tax": 354,

"return": 607

}

n = 250000

l_avg = 4

def calc_score(new_query, given_query):

score = 0

for term in given_query:

ftd = new_query.count(term)

ftd_ = ftd * math.log(1 + l_avg / len(new_query), 2)

num = math.log((1 + a[term] / n), 2) + ftd_ * math.log((1 + n / a[term]), 2)

den = (ftd_ + 1)

score += num / den

print(score)

new_query = ["california", "business", "tax"]

given_query = ["california", "business"]

calc_score(new_query, given_query)

new_query = ["california", "business", "tax", "return"]

calc_score(new_query, given_query)

["california", "business", "tax"] ---- > 11.038836781376123

["california", "business", "tax", "return"] ----> 10.035042371506819

(Edited: 2022-04-27) <pre>

import math

a = {

"california": 95,

"business": 601,

"tax": 354,

"return": 607

}

n = 250000

l_avg = 4

def calc_score(new_query, given_query):

score = 0

for term in given_query:

ftd = new_query.count(term)

ftd_ = ftd * math.log(1 + l_avg / len(new_query), 2)

num = math.log((1 + a[term] / n), 2) + ftd_ * math.log((1 + n / a[term]), 2)

den = (ftd_ + 1)

score += num / den

print(score)

new_query = ["california", "business", "tax"]

given_query = ["california", "business"]

calc_score(new_query, given_query)

new_query = ["california", "business", "tax", "return"]

calc_score(new_query, given_query)

# ["california", "business", "tax"] ---- > 11.038836781376123

# ["california", "business", "tax", "return"] ----> 10.035042371506819

</pre>

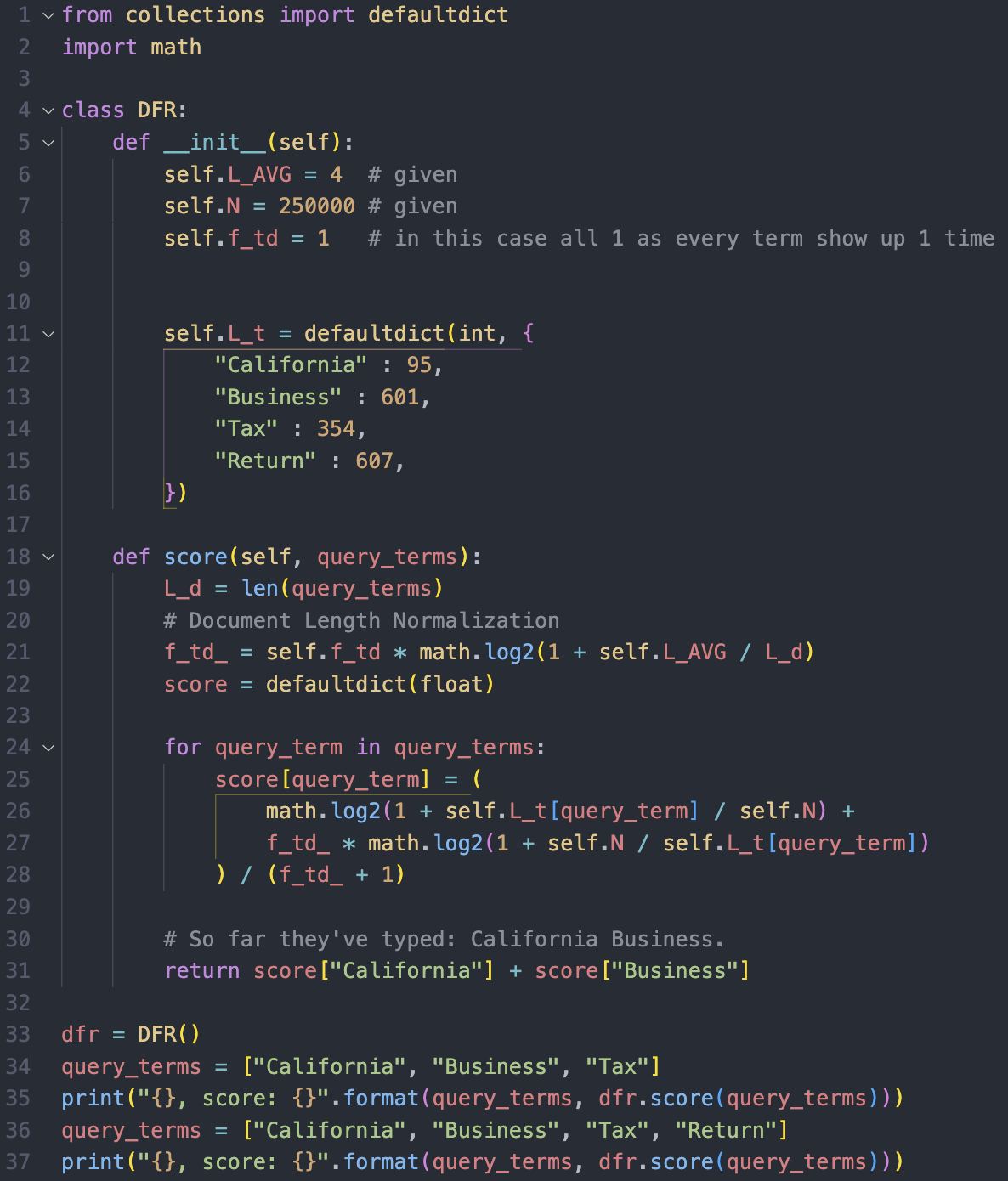

The output show as following:

['California', 'Business', 'Tax'], score: 11.038836781376123

['California', 'Business', 'Tax', 'Return'], score: 10.035042371506819

(Edited: 2022-04-27) ['California', 'Business', 'Tax'], score: 11.038836781376123

['California', 'Business', 'Tax', 'Return'], score: 10.035042371506819

((resource:Screen Shot 2022-04-27 at 4.11.43 PM.png|Resource Description for Screen Shot 2022-04-27 at 4.11.43 PM.png))

The output show as following: <br/>

['California', 'Business', 'Tax'], score: 11.038836781376123 <br/>

['California', 'Business', 'Tax', 'Return'], score: 10.035042371506819 <br/>

2022-04-28

package CS267;

public class InClassExercise_27Apr {

public static void main(String args[])

{

double n = 250000;

double l_t[] = new double[]{95, 601, 354, 607};

double f_t_d[] = new double[]{1,1,1,1};

double fprime_t_d[] = new double[4];

double l_avg =4;

// California Business Tax

double score = 0;

double l_d = 3;

for(int i=0;i<4;i++)

{

fprime_t_d[i] = f_t_d[i] * (Math.log(1+ (l_avg/l_d))/Math.log(2));

}

for(int i =0;i<2;i++)

{

double numerator = (Math.log(1+ (l_t[i]/n))/Math.log(2)) + fprime_t_d[i] * (Math.log(1+ (n/l_t[i]))/Math.log(2));

double denominator = fprime_t_d[i] + 1;

score = score + numerator/denominator;

}

System.out.println("California Business Tax "+score);

// California Business Tax Return

score = 0;

l_d = 4;

for(int i=0;i<4;i++)

{

fprime_t_d[i] = f_t_d[i] * (Math.log(1+ (l_avg/l_d))/Math.log(2));

}

for(int i =0;i<2;i++)

{

double numerator = (Math.log(1+ (l_t[i]/n))/Math.log(2)) + fprime_t_d[i] * (Math.log(1+ (n/l_t[i]))/Math.log(2));

double denominator = fprime_t_d[i] + 1;

score = score + numerator/denominator;

}

System.out.println("California Business Tax Return "+score);

}

}

<pre>

package CS267;

public class InClassExercise_27Apr {

public static void main(String args[])

{

double n = 250000;

double l_t[] = new double[]{95, 601, 354, 607};

double f_t_d[] = new double[]{1,1,1,1};

double fprime_t_d[] = new double[4];

double l_avg =4;

// California Business Tax

double score = 0;

double l_d = 3;

for(int i=0;i<4;i++)

{

fprime_t_d[i] = f_t_d[i] * (Math.log(1+ (l_avg/l_d))/Math.log(2));

}

for(int i =0;i<2;i++)

{

double numerator = (Math.log(1+ (l_t[i]/n))/Math.log(2)) + fprime_t_d[i] * (Math.log(1+ (n/l_t[i]))/Math.log(2));

double denominator = fprime_t_d[i] + 1;

score = score + numerator/denominator;

}

System.out.println("California Business Tax "+score);

// California Business Tax Return

score = 0;

l_d = 4;

for(int i=0;i<4;i++)

{

fprime_t_d[i] = f_t_d[i] * (Math.log(1+ (l_avg/l_d))/Math.log(2));

}

for(int i =0;i<2;i++)

{

double numerator = (Math.log(1+ (l_t[i]/n))/Math.log(2)) + fprime_t_d[i] * (Math.log(1+ (n/l_t[i]))/Math.log(2));

double denominator = fprime_t_d[i] + 1;

score = score + numerator/denominator;

}

System.out.println("California Business Tax Return "+score);

}

}

</pre>

((resource:Screenshot 2022-04-28 at 4.27.49 PM.png|Resource Description for Screenshot 2022-04-28 at 4.27.49 PM.png))

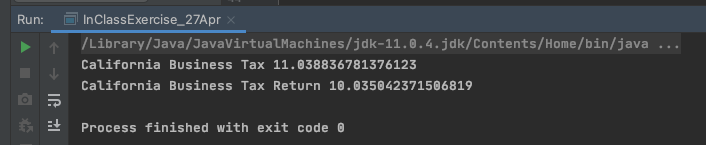

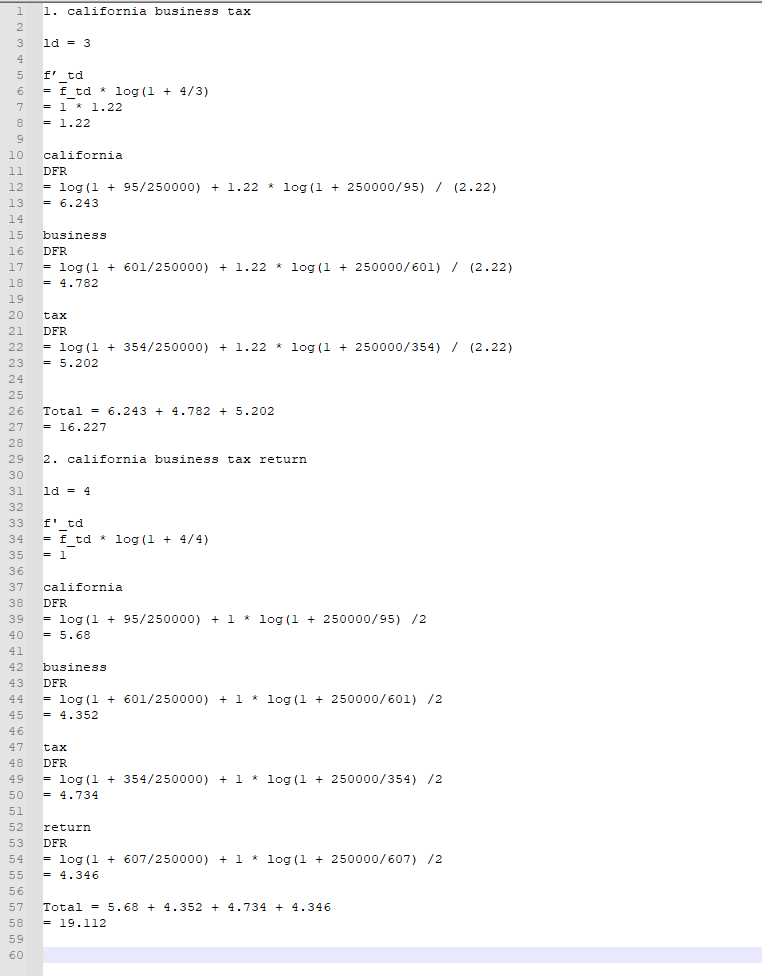

2022-04-30

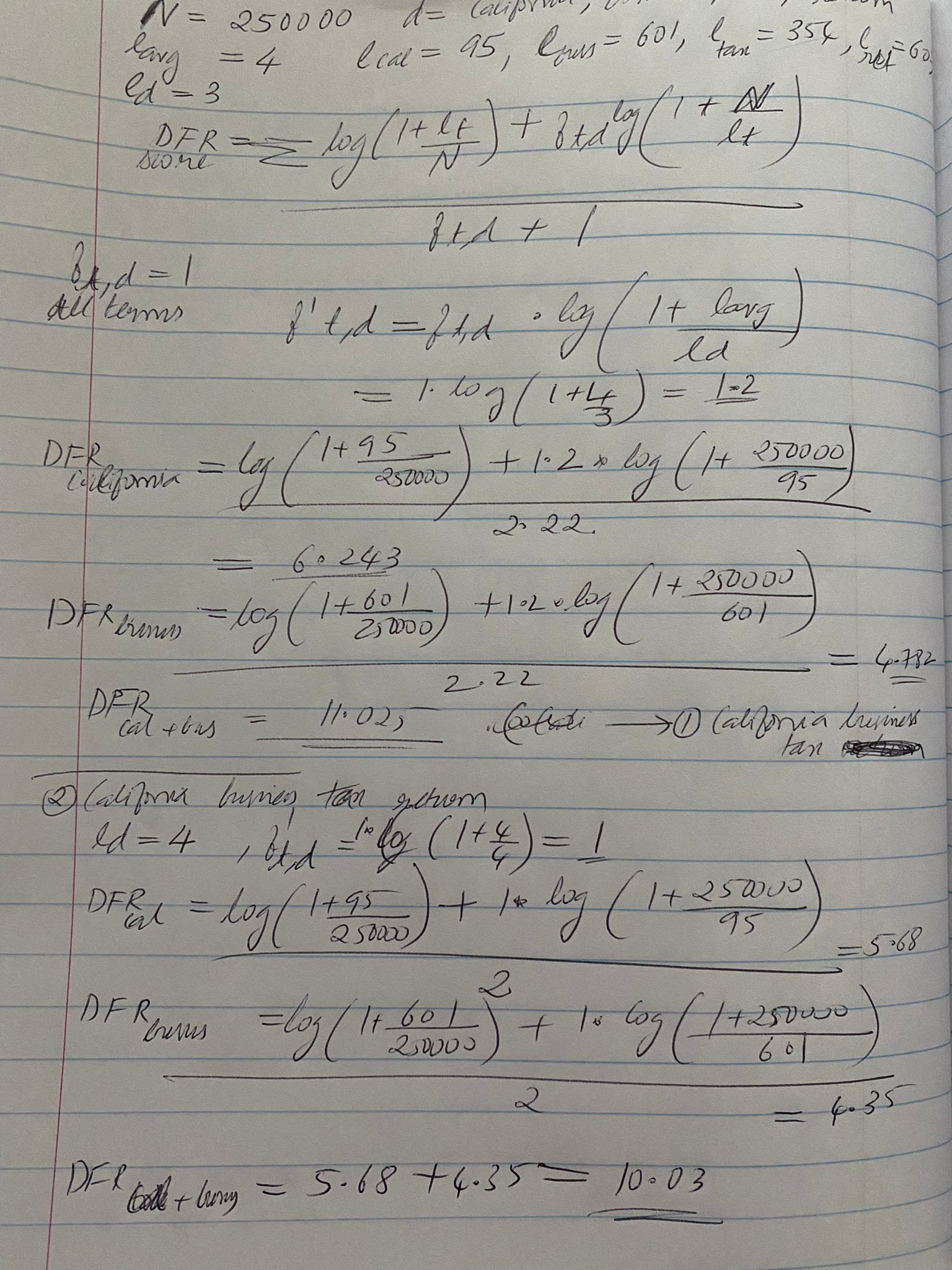

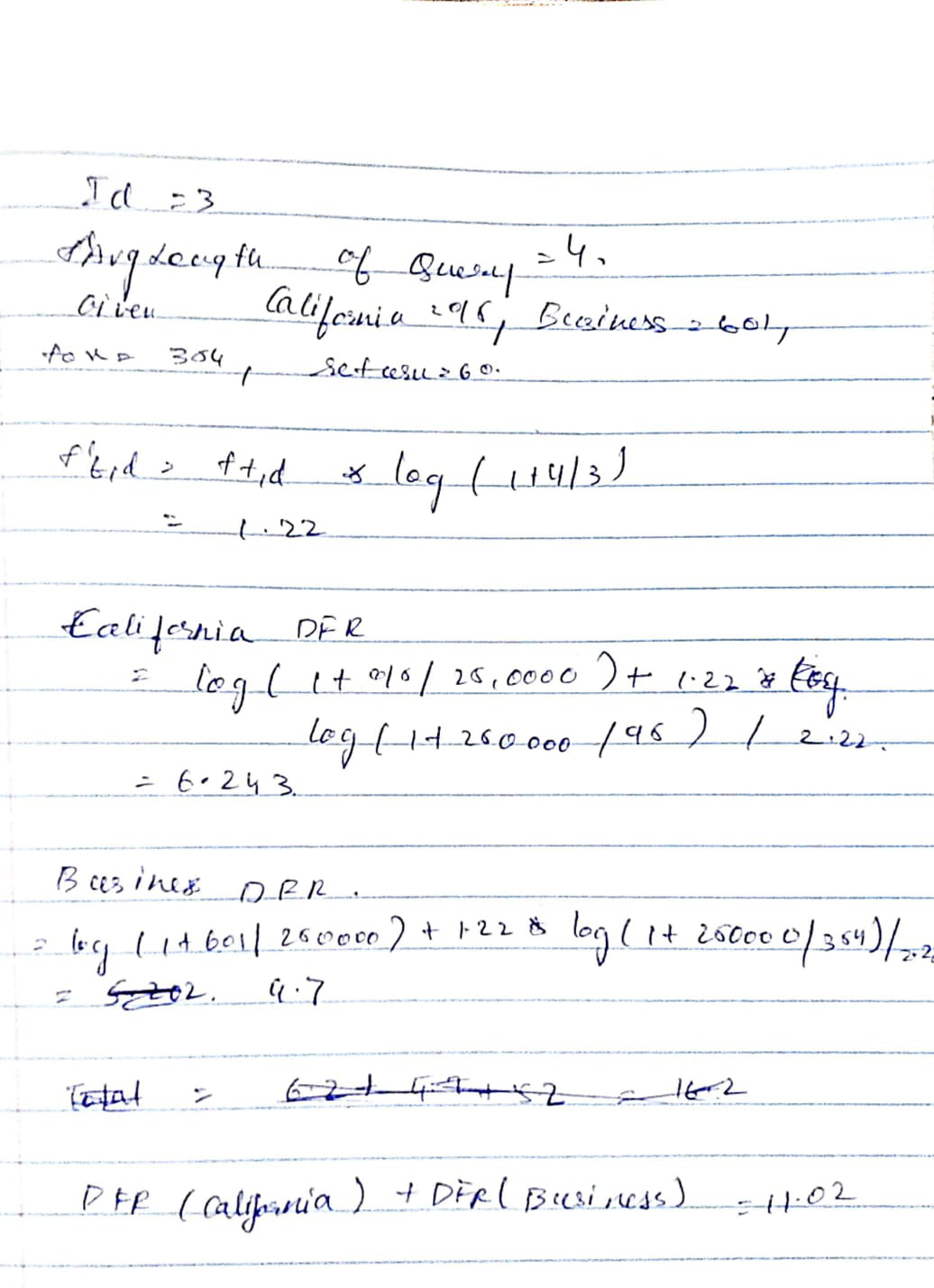

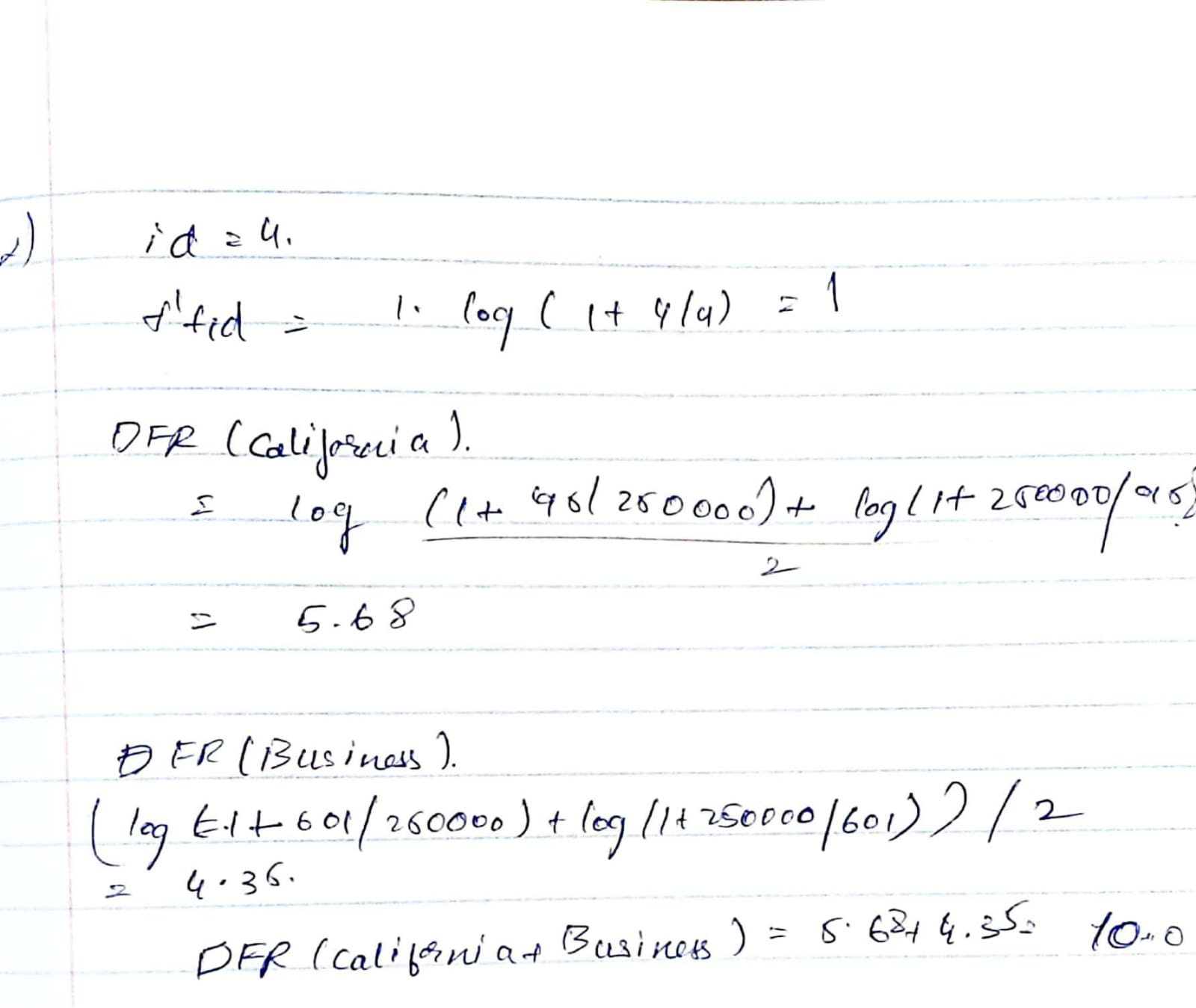

Given: size(corpus) = 250000 lavg(query) = 4 n(california) = 95, n(business) = 601, n(tax) = 354, n(return) = 607 DFR = sum[log(1+lt/N)+f't,d*log(1+N/lt) / f't,d+1] 1. california business tax ld = 3 ft,d (for each) = 1 f't,d (for each) = ft,d*log(1+lavg/ld) = 1*log(1+4/3) = log(7/3) = 1.22 DFR (california) = log(1+95/250000)+1.22*log(1+250000/95) / 2.22 = log(1.00038)+1.22*log(2632.58) / 2.22 = 0.00055 + 1.22*11.36 / 2.22 = 6.243 DFR(business) = log(1+601/250000)+1.22*log(1+250000/601) / 2.22 = log(1.0024)+1.22*log(416.97) / 2.22 = 0.0034+1.22*8.70 / 2.22 = 4.782 DFR(total_1) = 6.243 + 4.782 = 11.025 2. california business tax return ld = 4 ft,d (for each) = 1 f't,d (for each) = ft,d*log(1+lavg/ld) = 1*log(1+4/4) = log(2) = 1 DFR (california) = log(1+95/250000)+1*log(1+250000/95) / 2 = log(1.00038)+log(2632.58) / 2 = 0.00055 + 11.36 / 2 = 5.68 DFR(business) = log(1+601/250000)+1*log(1+250000/601) / 2 = log(1.0024)+log(416.97) / 2 = 0.0034+8.70 / 2 = 4.352 DFR(total_2) = 5.68 + 4.352 = 10.032

<pre>

Given:

size(corpus) = 250000

lavg(query) = 4

n(california) = 95, n(business) = 601, n(tax) = 354, n(return) = 607

DFR = sum[log(1+lt/N)+f't,d*log(1+N/lt) / f't,d+1]

1. california business tax

ld = 3

ft,d (for each) = 1

f't,d (for each) = ft,d*log(1+lavg/ld)

= 1*log(1+4/3) = log(7/3) = 1.22

DFR (california) = log(1+95/250000)+1.22*log(1+250000/95) / 2.22

= log(1.00038)+1.22*log(2632.58) / 2.22

= 0.00055 + 1.22*11.36 / 2.22

= 6.243

DFR(business) = log(1+601/250000)+1.22*log(1+250000/601) / 2.22

= log(1.0024)+1.22*log(416.97) / 2.22

= 0.0034+1.22*8.70 / 2.22

= 4.782

DFR(total_1) = 6.243 + 4.782 = 11.025

2. california business tax return

ld = 4

ft,d (for each) = 1

f't,d (for each) = ft,d*log(1+lavg/ld)

= 1*log(1+4/4) = log(2) = 1

DFR (california) = log(1+95/250000)+1*log(1+250000/95) / 2

= log(1.00038)+log(2632.58) / 2

= 0.00055 + 11.36 / 2

= 5.68

DFR(business) = log(1+601/250000)+1*log(1+250000/601) / 2

= log(1.0024)+log(416.97) / 2

= 0.0034+8.70 / 2

= 4.352

DFR(total_2) = 5.68 + 4.352 = 10.032

</pre>

((resource:image_67183617.JPG|Resource Description for image_67183617.JPG))

((resource:image_67159297.JPG|Resource Description for image_67159297.JPG))

((resource:image_67202049.JPG|Resource Description for image_67202049.JPG))

California business tax : 11.024

California business tax return : 10.033

2022-05-01

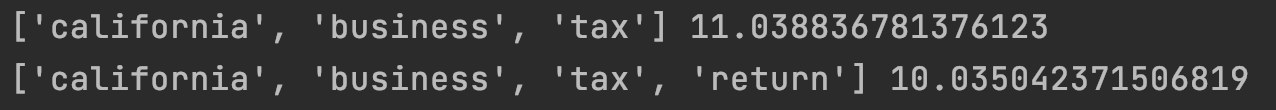

import math

def score(query, ld):

DFR = 0

ftd = 1

ftd_prime = ftd * math.log(1 + l_avg / ld, 2)

for term in query:

DFR += (math.log2(1 + occ[term] / N) + ftd_prime * math.log2(1 + N / occ[term])) \

/ (ftd_prime + 1)

return DFR

if __name__ == "__main__":

N = 250000

l_avg = 4

occ = {"california": 95, "business": 601, "tax": 354, "return": 607}

given = ["california", "business"]

query1 = ["california", "business", "tax"]

print(query1, score(given, len(query1)))

query2 = ["california", "business", "tax", "return"]

print(query2, score(given, len(query2)))

import math

def score(query, ld):

DFR = 0

ftd = 1

ftd_prime = ftd * math.log(1 + l_avg / ld, 2)

for term in query:

DFR += (math.log2(1 + occ[term] / N) + ftd_prime * math.log2(1 + N / occ[term])) \

/ (ftd_prime + 1)

return DFR

if __name__ == "__main__":

N = 250000

l_avg = 4

occ = {"california": 95, "business": 601, "tax": 354, "return": 607}

given = ["california", "business"]

query1 = ["california", "business", "tax"]

print(query1, score(given, len(query1)))

query2 = ["california", "business", "tax", "return"]

print(query2, score(given, len(query2)))

((resource:Screen Shot 2022-05-01 at 8.45.47 PM.png|Resource Description for Screen Shot 2022-05-01 at 8.45.47 PM.png))

(c) 2026 Yioop - PHP Search Engine